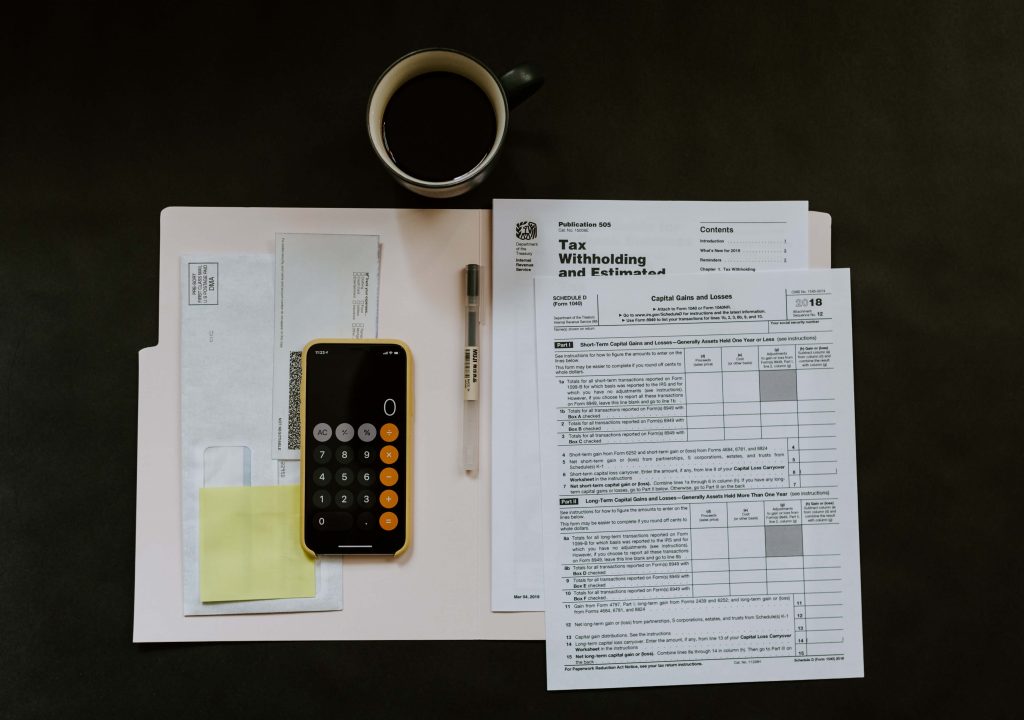

There are a couple of milestones that you will never forget while operating business. One of them is accessing your financial control: your numerous orders, employee payment, inventory cost, to name but a few. The stronger your ventures thrive, the more costs you may have to consider. They include the fee for new product lines, do research on demographics or enhance warehousing cost. Several costs are there for you to scale.

However, your profit may come later than the costs involved so it may become difficult to cover them. Don’t worry, this kind of issue can be dealt with by having your initial capital. That’s why having a detailed plan can make a difference in how you generate profits.

Which situations should you plan for?

1. Seasonal gaps

Manufacturers and sellers may see how sales figure differs according to different seasons. This is easily witnessed in the fashion industry. For instance, swimsuits gain in popularity during summer times while sweaters and thick-layered clothes are more preferred in cold weather.

The seasonal gaps lead to one massive problem: the imbalance between revenue and investment cost. It is because almost all types of businesses have to endure fixed costs that cannot be changed by season. Fixed costs include staff salary, inventory cost, renting, promotion. Hence such high profit earned from sales in peak seasons may not compensate for fixed costs and money of producing the output at first. This leads to a longer gap between cash flows.

Therefore, you should consider how to balance these costs in advance by making a strategic plan. Considering financing techniques on how to stay alive in off-season periods or under huge pressure of money flow will allow your business to thrive better.

2. Unexpected fall-down

No matter how many situations you have listed down to manage finance better, no one can help your business when unexpected events occur and increase your cost. Economic recession, buyer reactions, producing issues, trade war, restricted market laws, etc. If you are not prepared for these occasions, it is likely that your business may go bankrupt.

While dealing with these problems, the best solution is to have a new and sustainable capital resource to sail through dark times. A suitable and in-time capital allows your store to survive and even thrive in the fall-down period.

3. Issue of demand growth

It may sound ironic, but the growth of one business can pose potential risks and harms to its financial sustainability. Such cash flow challenges happen when there is a sudden rise in market demand. A temporary increase in the costs for shipping, packaging expenses producing costs can widen the gap of cash flow. At the same time, money earned comes later. Another cost born due to the growth in demand better customer service network, labor needed requires more expenses than usual. However, profit cannot can in advance.

The best way to address the issue is by getting new capital to remain the number of customers and their expectations about your products.

A financial plan reduces those risky moments.

In business, planning ahead of all unexpected occasions help you to reduce the risks of going bankrupt. All of the planning processes are easy to do and lead to efficient results.

1. A deep understanding of the seasonality.

Depending on different kinds of industry, seasonality varies. This helps you to allocate money more effectively and know where to scatter dollars to balance cash flow. By making detailed researches on your chosen industry, you will fulfill yourself with the peak seasons and vice versa. A tip for taking away is that you can broaden your knowledge in various ways. You can check out the operation of your competitors, market trends, consult ideas of people working in that field to have an exact result of timing. Later, you should transfer them into the weekly and monthly financial schedule to keep track of them better.

2. Having a risk fund for risky moments

No one can assure you that there would be no harsh storms coming for your business. During such an unpleasant period, a comfy season would be an emergency fund. This risk cushion will help you get through the economic recession, a dark event, unexpected demand growth. If you have not launched your business, keep in mind to write down all essential factors that can affect your money balance. A detailed plan on how to cope with bad times can make you reallocate money more effectively. If your business is already in operation, remember to set aside an amount of revenue to prepare for some unanticipated events.

The portion of the money saved depends on how you direct your business: if it is too little, then the level of risk is higher and you may find it more difficult to get through tough times. If money is too much, you may eat up of chances of growing today to expect what might never come.

3. Reach out for a financial partner

A suitable financial partner can give you a fresh capital in the needed time. As timing is everything, a partner who helps to address financial issues can make a huge difference to the business. It is especially important if you are undergoing some money crisis. Financial partners will not exert an overwhelming requirement to deliver financial help like documents and waiting periods.

In the end, it is all about having a good plan and stick to it. An effective one should include the detail of projects and all the money it takes to fulfill your business, even in trouble times. Therefore, you can seek financial support in a more active way and have in mind what’s coming ahead to prepare for it.

Planning matters in making sure you are not suffering from bankruptcy and other financial issues. In addition, as you make plans, you will figure out is there anything can be improved, whether it is operational processes, customer service or promoting issues. Hence, a close glimpse at some cool Shopify apps can assist you to tackle headache issues, so why not give it a try?